Inflation Reduction Act and What It Means for Nevada

Subscribe to our email newsletter and follow us on social media.

The Inflation Reduction Act was signed into law by President Biden earlier this month. It provides historic investments in reducing climate pollution, accelerating the transition to clean energy, and advancing low- and zero-pollution transportation.

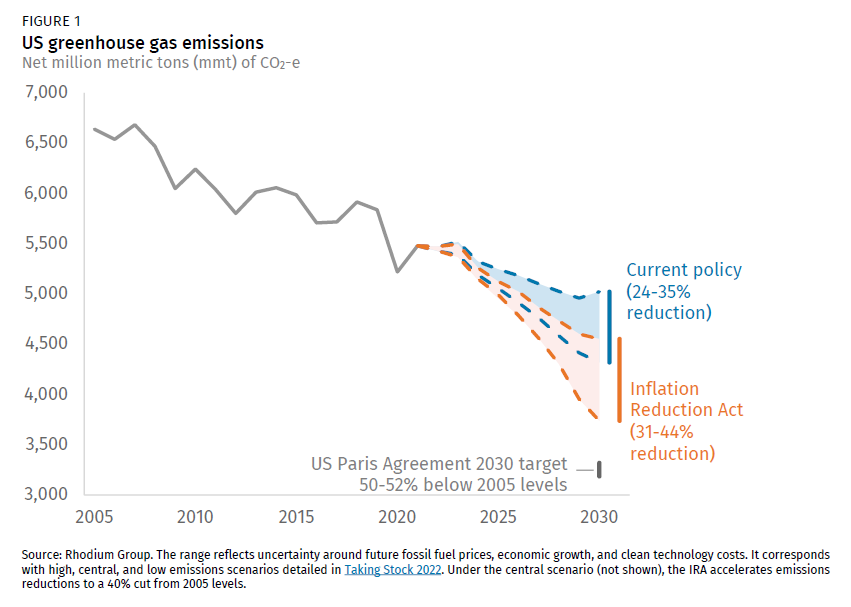

The new law will bring an estimated $2.7 billion of investment in large-scale clean power generation and storage to Nevada by 2030. According to an article published by Rhodium Group, an independent research firm, “Our preliminary estimate is that the IRA can cut US net greenhouse gas emissions down to 31% to 44% below 2005 levels in 2030—with a central estimate of 40% below 2005 levels—compared to 24% to 35% under current policy."

Lower Energy Costs

The Inflation Reduction Act will offer rebates covering 50-100% of the cost of installing new electric appliances for eligible low- and moderate-income households. The act also provides tax credits covering 30% of the costs to install solar panels and battery storage systems with no income limits apply. For solar, uptake projections estimate that over 75,000 additional Nevada households will install rooftop panels as a result. For community solar projects owned by local businesses, the act provides tax credits covering 30% of the costs and an additional bonus credits of 20% for projects at affordable housing properties and 10% for projects in low-income communities.

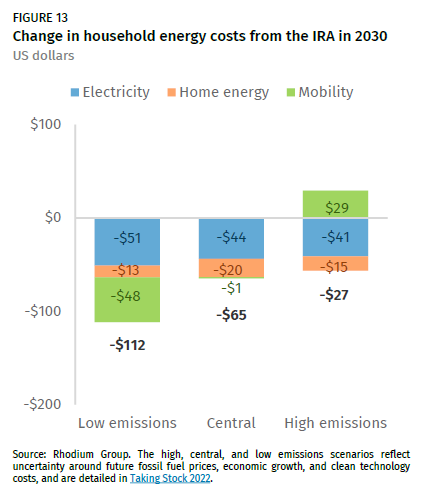

"All together, we estimate household energy costs will decrease by between $717 and $1,146 in 2030, relative to 2021 levels," according to Rhodium Group, an independent research firm.

Commercial building owners can receive a tax credit up to $5 per square foot to support energy efficiency improvements. Small businesses can receive tax credits covering 30% of the costs of installing low-cost solar power and of purchasing clean trucks and vans for commercial fleets.

Create Clean Energy Jobs

In 2021, there were 32,378 Nevada workers employed in clean energy jobs. With the new act, it provides tax credits for businesses in the solar, wind, storage, and other clean energy industries that pay a prevailing wage.

According to a 2020 report published by E2, a national, nonpartisan group with more than 9,000 members who advocate for clean energy policies, federal clean energy stimulus investments similar to those adopted in the Inflation Reduction Act would add more than 39,000 clean energy jobs in Nevada over five years.

Electric Vehicles

The act offers upfront discounts up to $7,500 for new EVs and $4,000 for used EVs. Nevada is also getting federal funding from the Infrastructure Investment and Jobs Act over five years to build more electric charges across the state.

Others

Electric cooperatives, which serve about 40,000 homes, businesses, and other customers in Nevada, will for the first time be eligible for direct-pay clean energy tax credits.

Last week, Congresswoman Dina Titus and Congresswoman Susie Lee, State Senators Dallas Harris and Roberta Lange, Assemblywoman Rochelle Nguyen, and Nevada State AFL-CIO Executive Secretary-Treasurer Susie Martinez joined climate leaders to celebrate the passage of the Inflation Reduction Act and the Infrastructure Investment and Jobs Act.

“The historic passage of the Inflation Reduction Act is a huge win for Nevada families for many reasons, including grants and tax credits that will help accelerate the transition to clean energy,” said Congresswoman Titus. “This law will boost Nevada’s economy while simultaneously expediting the transition to clean electricity in our State. It will create good-paying jobs and reduce kitchen table costs for hard-working Nevadans.”

Subscribe to our email newsletter and follow us on social media.