Subscribe to our email newsletter and follow us on social media.

The Private Bank by Nevada State Bank released its second issue of High Net Worth Report in 2022. The report provides an overview on wealth growth and retirement trends in recent years in Nevada. It looked at two key drivers of wealth growth - the stock market and home equity, and the corresponding trends in labor force participation for residents aged 55 and over in Nevada.

Highlights from the report include:

- Between March 2020 and May 2022, the share of Nevadans aged 55 and over in the labor force fell by 4.7 percentage points from 40.8 percent to 36.1 percent (a change from about 362,900 to 340,300).

- While the number of retirees had been steadily declining from 2018 to early 2021, the share of retired Nevadans aged 55 and over increased by 4.8 percentage points to 54.7 percent between February 2021 and May 2022.

- Between the third quarter of 2019 and the end of 2021, Americans aged 55 and over added $22.8 trillion in assets, with $11.5 trillion, or 57.6 percent, of this increase coming from investments in stocks and mutual funds.

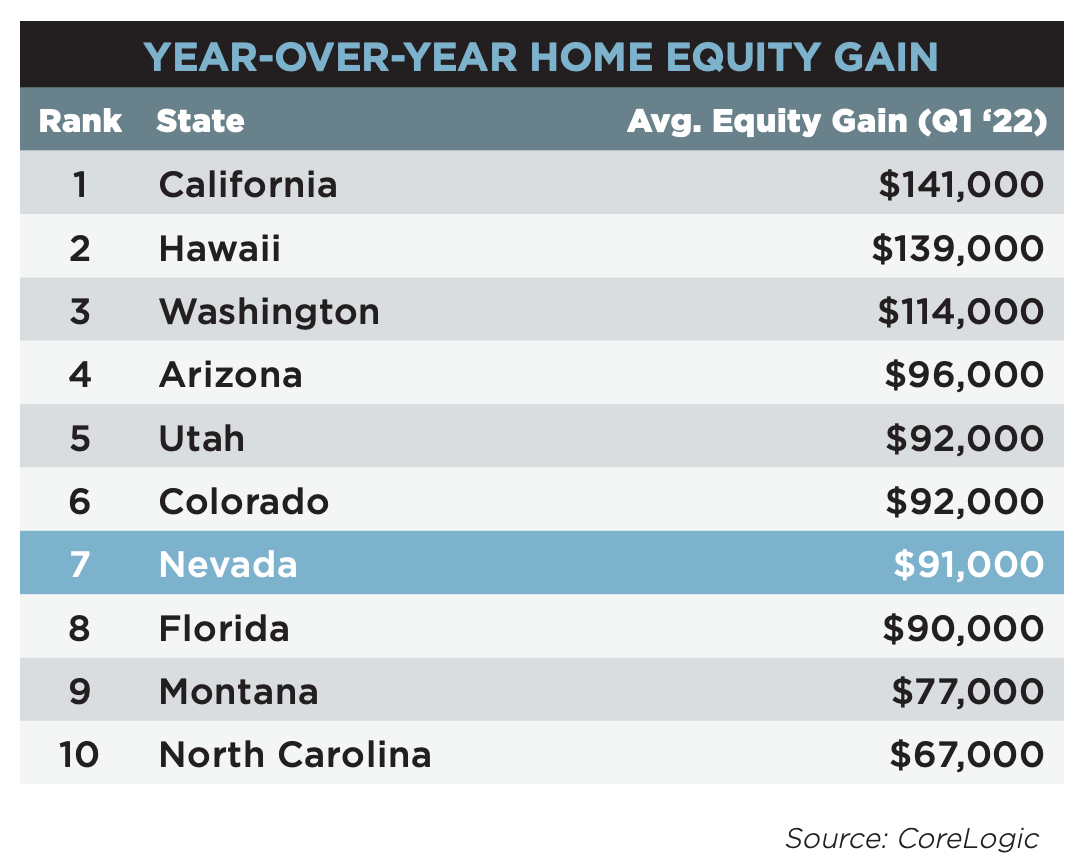

- Nevada homeowners gained an average of $91,000 in equity in the first quarter of 2022 compared to the prior year, the seventh-largest year-over-year home equity gain in the United States.

“We saw a rise in the number of retirees in the 55-and-over age segment in Nevada in recent months,” said James Rensvold, Executive Vice President and Director of Private Banking. “Many households in Nevada saw significant gains in overall household wealth, particularly as the value of investment portfolios and home values increased over the last two years, which potentially impacted the horizon for Nevadans nearing retirement.”

The Private Bank’s High Net Worth Report is available on Nevada State Bank’s website at www.nsbank.com/HNWreport or by contacting The Private Bank directly at 702.855.4596.

Subscribe to our email newsletter and follow us on social media.