Subscribe to our email newsletter and follow us on social media

The Tile Council of North America, a trade association representing manufacturers of ceramic tile and related products, recently released its 2021 ceramic tile and housing market update.

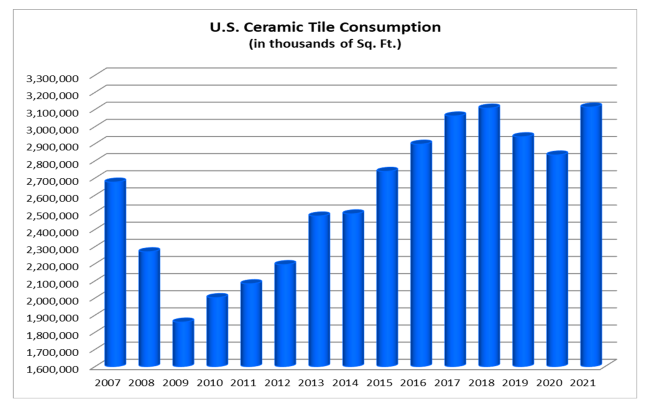

U.S. Tile Consumption Overview:

Supported by gains in the U.S. construction and housing markets and robust overall economic growth, U.S. ceramic tile consumption increased for the first time since 2018.

Total U.S. ceramic tile consumption in 2021 was 3.11 billion sq. ft., up 9.9% from the previous year.1

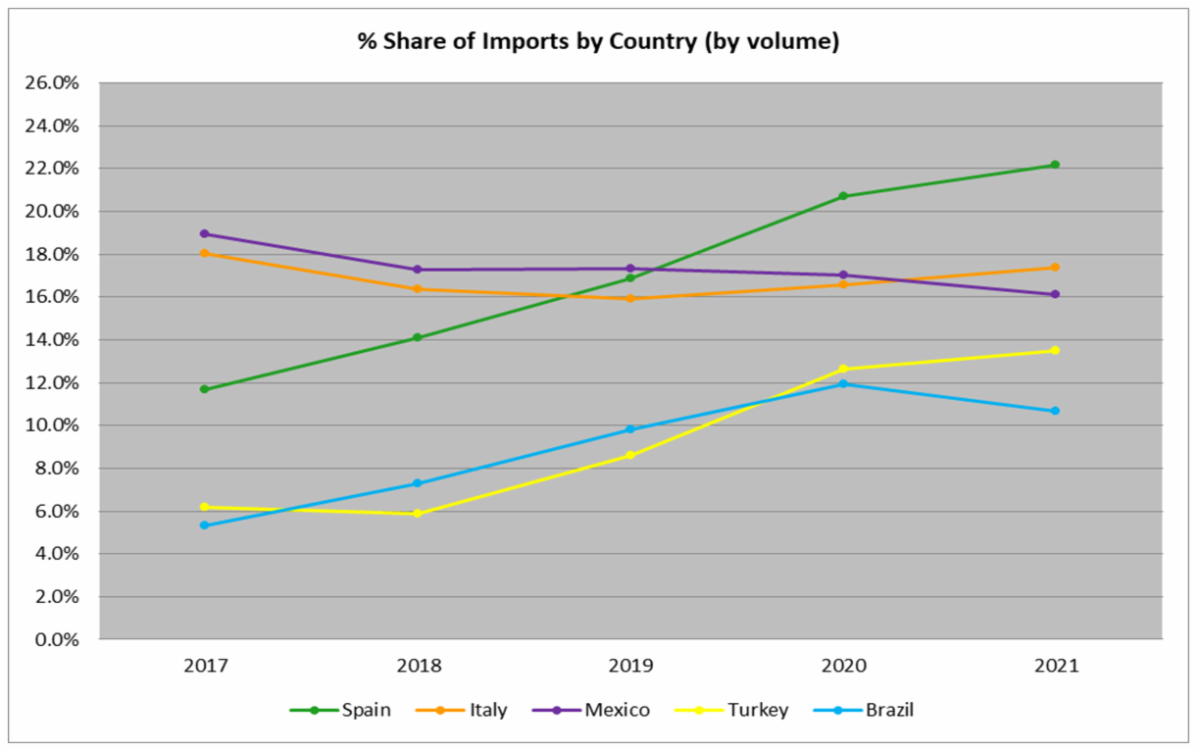

Imports:

U.S. imports in 2021 reached their highest level in fifteen years. The 2.23 billion sq. ft. of tile imported last year was a 13.6% increase from 2020.2

Spain, which in 2020 supplanted China as the largest exporter of ceramic tile to the U.S. by volume, maintained this position. Spanish imports held a 22.2% share of total U.S. imports by volume in 2021, up from 20.7% the previous year.

Italy was the second largest exporter to the U.S. by volume, its highest position since 2008. Italian-produced tiles made up 17.4% of the U.S. import market last year, up from 16.6% the previous year.

On a dollar basis (CIF + duty) Italy remained the largest exporter to the U.S. making up 31.6% of 2021 U.S. imports, followed by Spain (25.3% share) and Mexico (9.8% share).

U.S. Shipments:

U.S. manufacturers shipped 880.3 million sq. ft. of ceramic tile domestically last year, a 1.5% increase from 2020.

Though imports’ share of U.S. consumption grew from 69.4% in 2020 to 71.7% last year, domestically-produced tiles’ share of consumption (28.3%) remained far ahead of all other individual countries exporting tile to the U.S., with the nearest being Spain (15.9% of U.S. tile consumption), Italy (12.5%), and Mexico (11.5%).

U.S. Exports:

U.S. ceramic tile exports in 2021 were 38.0 million sq. ft., a 22.5% increase from the previous year. The two largest consumers of U.S. exports by volume were Canada (70.7%) and Mexico (14.3%).

The value of U.S. exports rose 29.8% from $31.2 million in 2020 to $40.4 million last year.3

Housing Market Highlights:

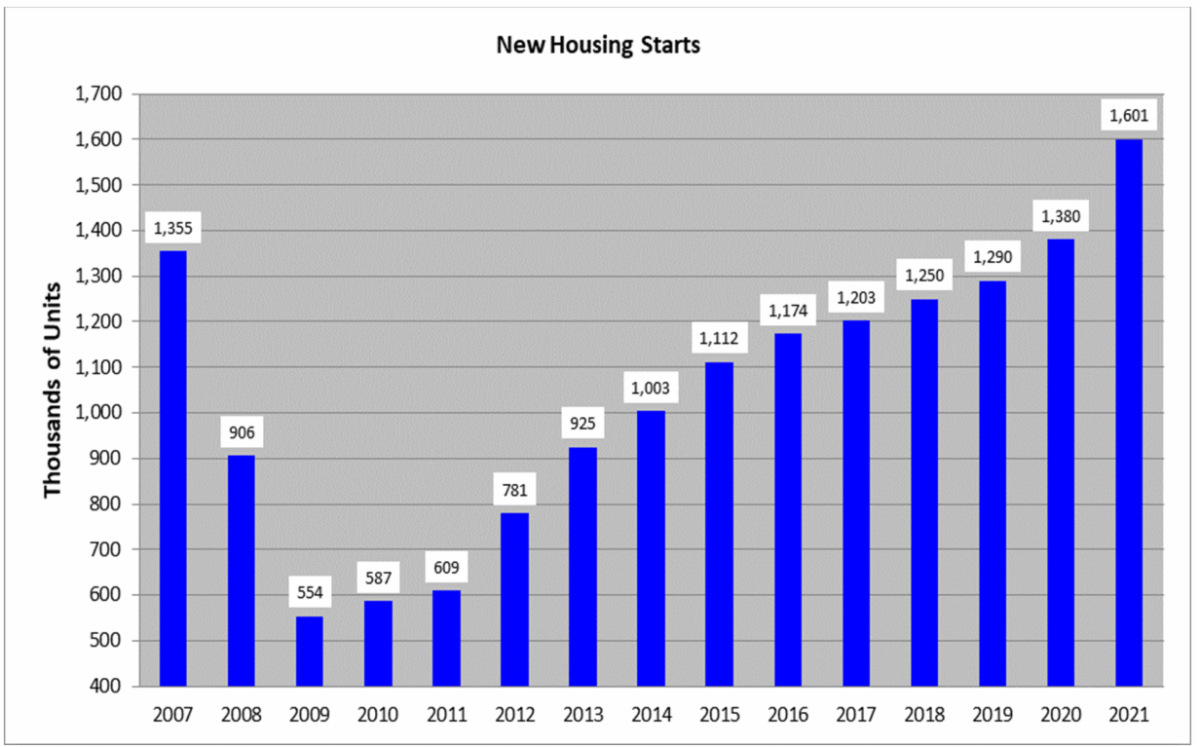

New Home Starts

In the residential market, despite supply chain and labor issues, new home starts rose for the twelfth consecutive year and were at their highest point since 2006. The 1.60 million units started in 2021 represented a 16.0% increase from the previous year.4

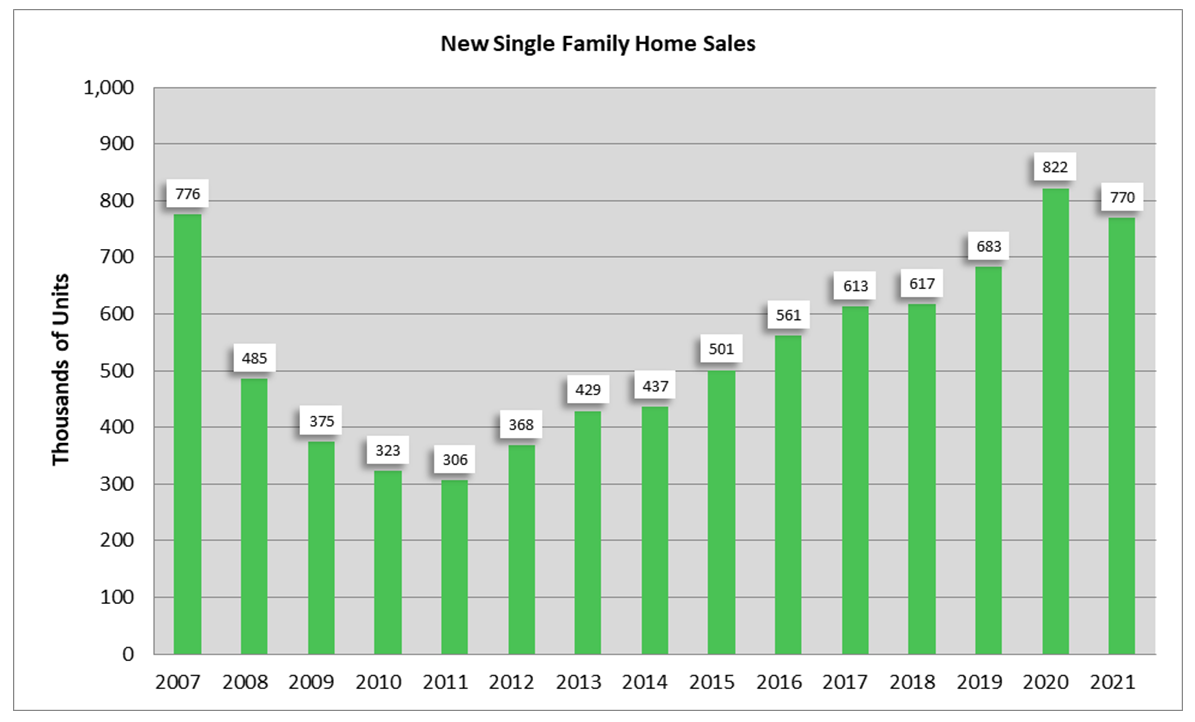

New Single-Family Home Sales

With record-high average new home prices and a low supply of available properties, new single-family home sales fell for the first time in a decade. The 770,000 units sold in 2021 represented a 6.3% decline from the previous year.5

1 U.S. Dept. of Commerce & Tile Council of North America

2 U.S. Dept. of Commerce

3 U.S. Dept. of Commerce

4 U.S. Census Bureau

5 U.S. Census Bureau

Subscribe to our email newsletter and follow us on social media